When it comes to measuring regional economies, go-to statistics typically include employment and earnings. Released monthly, industry employment counts can be the first signs of economic growth or decline. This was certainly the case in Spring 2020 when monthly job counts showed sharp declines in the leisure and hospitality industry. These were some of the oft-cited early indicators of Covid-19’s impact on the economy. There are, however, other revealing categories within labor market data. Tabluting the number and variety of business establishments reveals another wrinkle in the story. Data on the number of businesses show that as individuals were laid off or left their jobs, they started new businesses in a variety of industries.

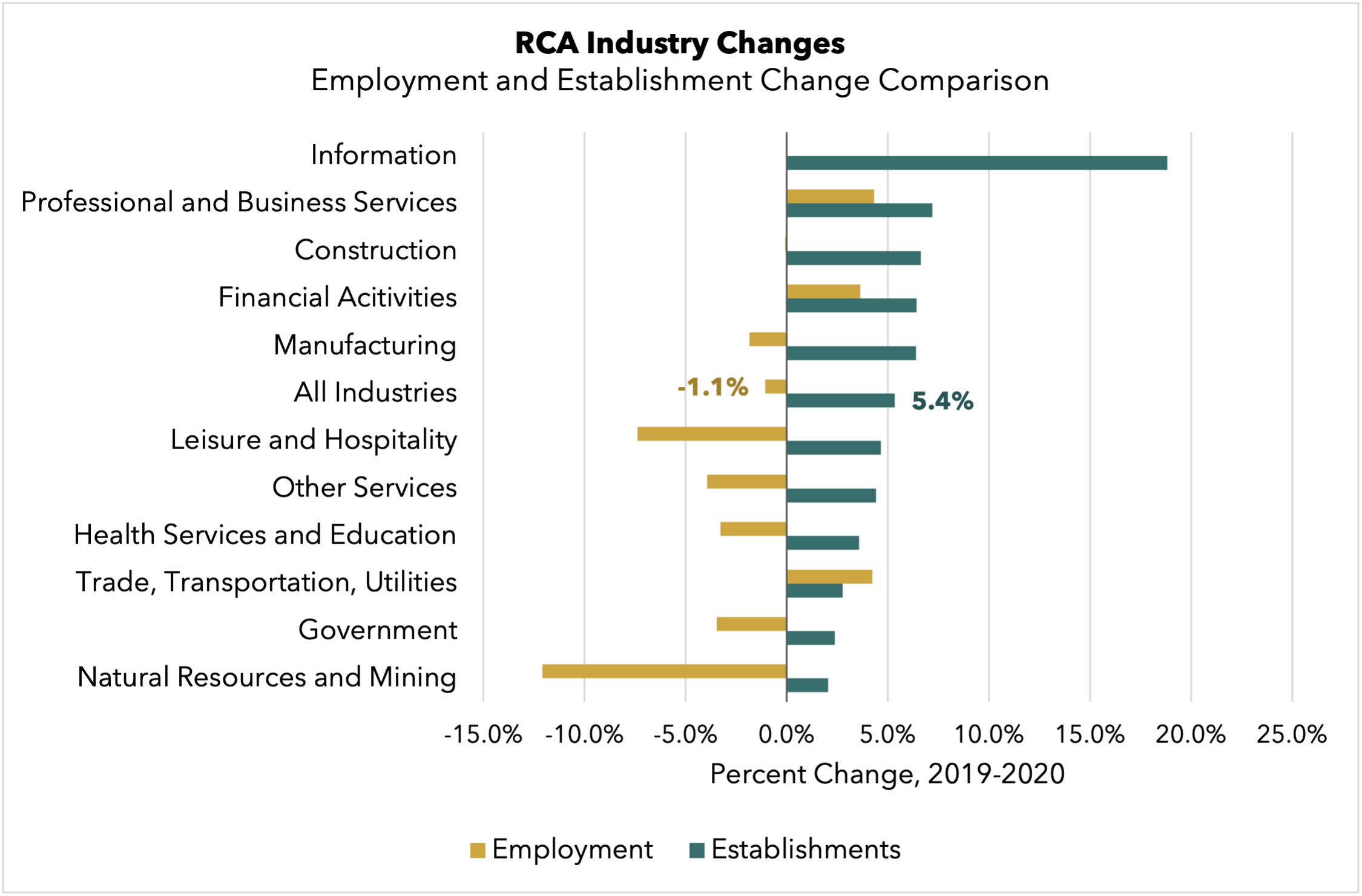

Available on the Rural Capital Headlight website, recently updated numbers from the Census Bureau’s County Business Patterns (CBP) survey show that while employment fell in the RCA over the course of 2020, the number of businesses increased. On average, employment fell 1.1% over the course of the year, but the number of businesses increased 5.4%. See the chart below, with businesses represented as “establishments.”

Note: Employment change is measured from Q4 2019 to Q4 2020. The information industry is blank because no employment data were available in Q4 2019. From Q3 2019 to Q4 2020 however, information employment shrank by 22.7% (916 jobs).

In fact, the number of businesses grew in every major industry in the RCA in 2020, despite the fact that employment fell in all but three sectors: professional services, finance, and transportation. This 5.4% growth equates to more than 1,200 new businesses opening in the RCA from 2019 to 2020. A quarter of these new businesses (310) were in professional and business services, and the second highest number of new operations were in the construction industry (176).

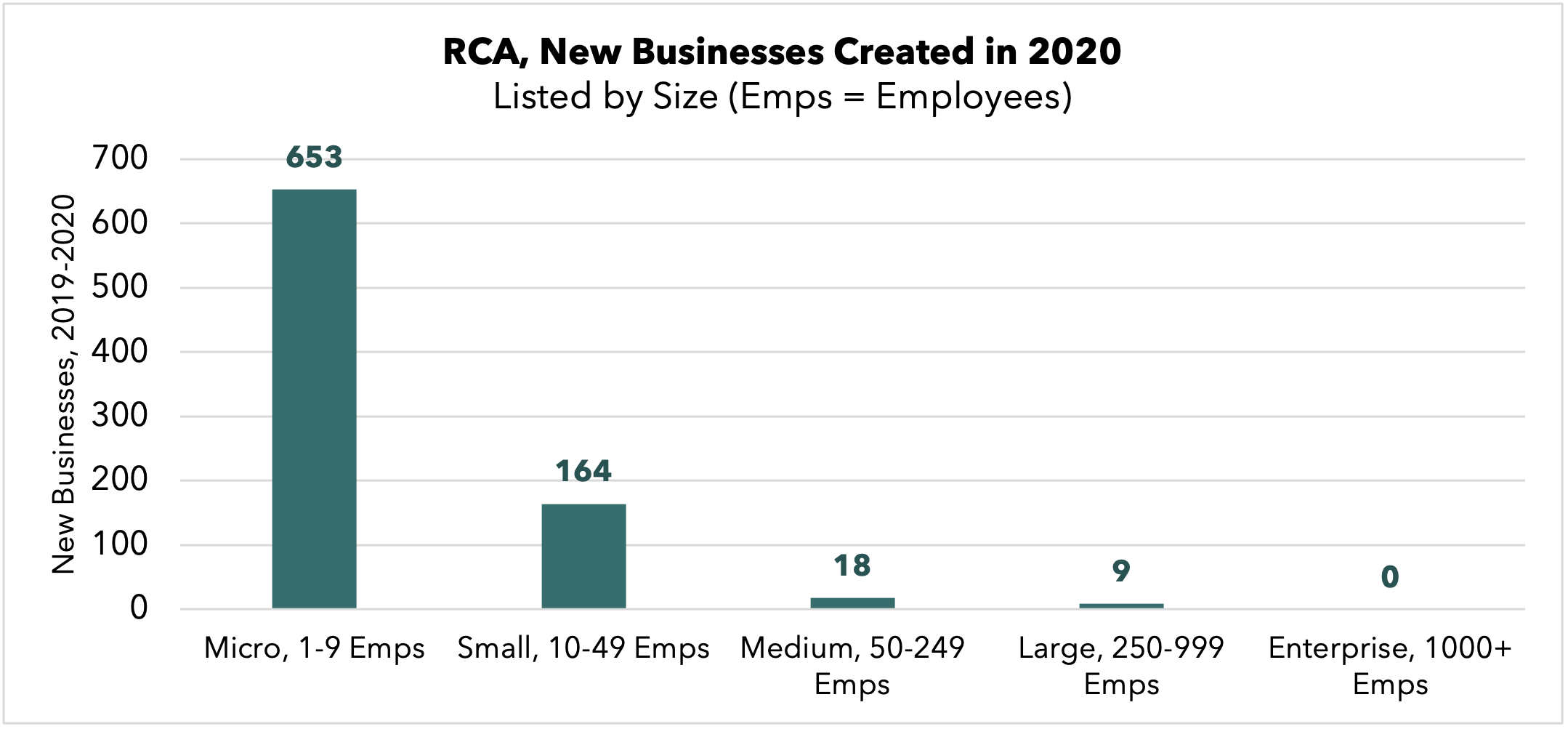

Initially, this phenomenon of falling employment but increasing businesses may seem counterintuitive. However, it comes together after accounting for the fact that during recessions, large businesses are more likely to enact layoffs and hiring freezes than small to medium-sized businesses. A large business can lay off multiple people, greatly impacting the employment rate, while having no impact on the number of businesses in the economy. It is likely that some of those individuals who were laid off or left their jobs as early participants of the great resignation started their own ventures. This bears out in the local data as well. Of the new businesses created in the RCA in 2020, the majority were micro-firms, classified as having one to nine employees. See the chart below.

Note: The total number of new businesses shown in this chart does not add up to 1,200 based on the use of a separate data source to show new firms by size, rather than industry alone.

A look one level deeper reveals a silver lining. Similar to the industry distribution for all sized businesses, the industry with the largest increase of new micro-firms in the RCA was professional and technical services (187 new micro-firms). Professional and technical services is a high-propensity industry, meaning new ventures in this space are likely to grow and create more jobs. Legal services and architectural and engineering services are sub-industries within this category that count as high propensity businesses.

The industry creating the second highest number of new micro-firms in 2020 was construction (119 new micro-firms), highlighting another dynamic of new business starts, the independent contractor. While some construction businesses, such as heavy and civil engineering firms, are likely to employ many people as they grow, it is probable that these new business owners are individual contractors, focused on residential remodeling, who became entrepreneurs out of necessity.

At the county level, construction, professional services, and manufacturing were some of the top industries for new business growth. The table below lists the total number of new businesses created in each county and the industry adding the most establishments.

|

County |

New Business |

Net New |

Top Industry (number of new businesses) |

|

Bastrop |

3.7% |

58 |

Construction (22) |

|

Blanco |

3.6% |

15 |

SLeisure and Hospitality (8) |

|

Burnet |

4.0% |

55 |

Construction (17) |

|

Caldwell |

4.1% |

31 |

Professional and Business Services (8) |

|

Fayette |

0.6% |

5 |

Natural Resources and Mining (4) |

|

Hays |

5.8% |

278 |

Professional and Business Services (68) |

|

Lee |

0.2% |

1 |

Other Services (3) |

|

Llano |

0.0% |

- |

Financial Activities (4) |

|

Williamson |

6.5% |

768 |

Professional and Business Services (204) |

Overall, new business establishments failed to make up for the total number of jobs lost. But the establishment data reveal the resiliency of businesses and individuals in the RCA. The number of businesses grew in the RCA during 2020 as entrepreneurs took advantage of a rapidly changing economy.